1. Introduction

Accepting card payments is crucial for businesses today. Paygen offers seamless, secure card processing, guiding you through each step.

Our expertise ensures you understand the lifecycle, from initial transaction to settlement. This knowledge empowers you to provide a smooth payment experience for customers.

Paygen’s Commitment

At Paygen, we prioritize:

- Reliability

- Efficiency

- Security

Our solutions are tailored to your unique business needs, fostering long-term partnerships built on trust.

2. What is Card Processing?

Card processing is the backbone of electronic payments, enabling businesses to securely accept credit and debit card transactions from customers. It’s a crucial component of modern commerce, facilitating the seamless transfer of funds between merchants, payment processors, and financial institutions.

At Paygen, we understand the intricate details of card processing, and we’re dedicated to offering reliable and efficient solutions that meet the unique needs of your business.

The Key Players

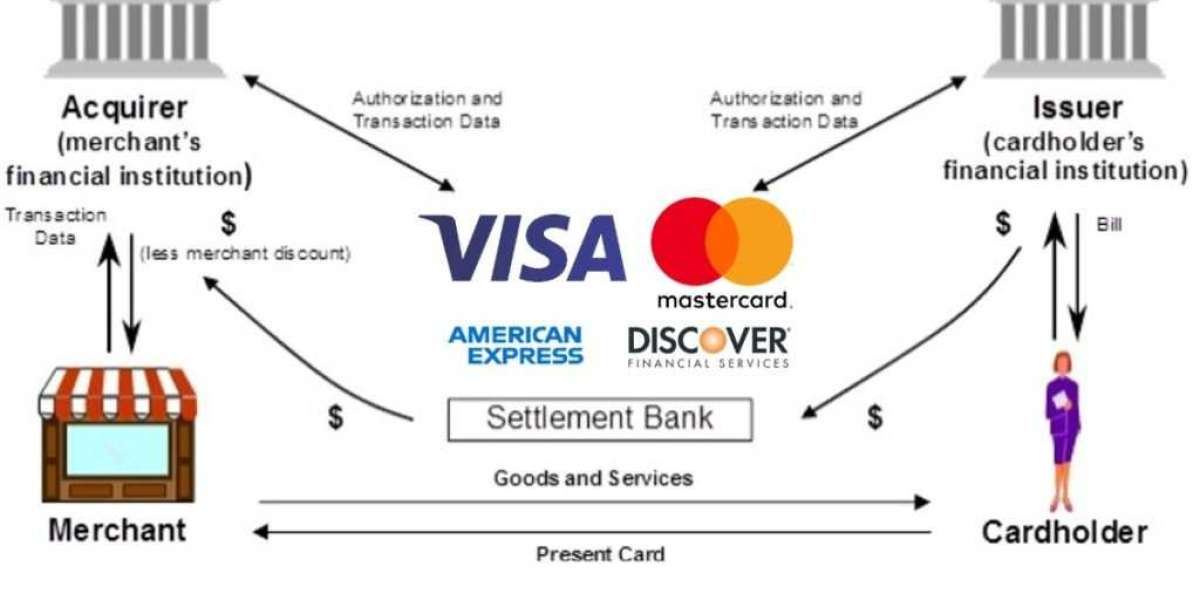

The card processing ecosystem involves several key players working in tandem:

- Merchant: The business accepting card payments from customers.

- Payment Gateway: The technology that securely transmits transaction data between the merchant and the payment processor.

- Payment Processor: The entity that facilitates the communication between the merchant’s bank and the card-issuing bank.

- Issuing Bank: The financial institution that issued the customer’s credit or debit card.

- Acquiring Bank: The financial institution that maintains the merchant’s account and processes transactions.

| Player | Role |

|---|---|

| Merchant | Accepts card payments from customers |

| Payment Gateway | Securely transmits transaction data |

| Payment Processor | Facilitates communication between banks |

| Issuing Bank | Issues the customer’s credit/debit card |

| Acquiring Bank | Maintains the merchant’s account and processes transactions |

Paygen’s Expertise

At Paygen, we have in-depth knowledge of the card processing landscape. Our solutions seamlessly integrate with leading payment gateways and processors, ensuring a smooth and secure payment experience for your customers.

We understand that every business has unique needs, which is why we offer customizable card processing solutions tailored to your specific industry, transaction volume, and requirements.

With Paygen as your trusted partner, you can focus on growing your business while we handle the complexities of card processing, ensuring compliance with industry standards and providing top-notch security for your transactions.

3. The Card Processing Lifecycle

The card processing lifecycle is a multi-step journey that a transaction undertakes, from the initial swipe or tap to the final settlement of funds. Understanding this lifecycle is crucial for businesses to manage their payment processes effectively and ensure a seamless experience for customers.

At Paygen, we take pride in our in-depth knowledge of the card processing lifecycle, enabling us to provide comprehensive support and guidance to our clients.

The Steps Involved

- Authorization

- The transaction is initiated, and the card information is transmitted to the issuing bank for approval.

- The issuing bank verifies the available funds and card validity, then approves or declines the transaction.

- Batching

- Approved transactions are temporarily held in a “batch” by the payment processor.

- At the end of the business day, the batch is closed and sent to the acquiring bank.

- Clearing and Settlement

- The acquiring bank facilitates the transfer of funds from the issuing bank to the merchant’s account.

- This process typically takes 1-3 business days.

- Funding

- The merchant’s account is credited with the settled funds, minus any applicable processing fees.

- The merchant can now access and utilize the funds from the processed transactions.

Paygen’s Seamless Integration

At Paygen, our advanced technologies and robust systems are designed to streamline the card processing lifecycle for our clients. We seamlessly integrate with leading payment gateways and processors, ensuring smooth and secure transactions at every step.

Our team of experts closely monitors each transaction, proactively addressing any potential issues and providing timely support to ensure a hassle-free payment experience for your business and your customers.

With Paygen as your trusted partner, you can rest assured that your card processing needs are in capable hands, allowing you to focus on growing your business while we handle the complexities of the payment lifecycle.

4. Compliance and Security

In the world of card processing, compliance and security are paramount. Businesses must adhere to industry standards and regulations to protect sensitive cardholder data and maintain the trust of their customers.

At Paygen, we understand the critical importance of compliance and security, which is why we have implemented robust measures to safeguard your transactions and ensure the highest levels of data protection.

PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of requirements designed to enhance payment card data security. Paygen is fully compliant with PCI DSS, ensuring that we handle, process, and store cardholder data in a secure manner.

Our processes and systems are regularly audited and tested to maintain compliance, giving you peace of mind knowing that your customers’ sensitive information is protected.

Advanced Security Measures

In addition to PCI DSS compliance, Paygen employs advanced security measures to protect your transactions:

- Encryption: All transaction data is encrypted using industry-standard protocols, ensuring that sensitive information remains secure during transmission.

- Tokenization: Cardholder data is replaced with non-sensitive placeholders (tokens), reducing the risk of data breaches.

- Fraud Detection: Our sophisticated fraud detection systems monitor transactions for suspicious activity, helping to prevent fraudulent transactions and chargebacks.

- Regular Updates: Our security protocols are regularly updated to address emerging threats and vulnerabilities.

Paygen’s Commitment to Security

At Paygen, we understand that security is an ongoing process, not a one-time fix. Our dedicated team of security experts continuously monitors the threat landscape, implementing the latest security measures to protect your business and your customers.

By partnering with Paygen, you can have confidence in the security and integrity of your card processing operations, allowing you to focus on growing your business while we handle the complexities of compliance and data protection.

5. Paygen’s Competitive Advantage

In the competitive landscape of card processing, Paygen stands out as a trusted partner for businesses seeking reliable, secure, and efficient payment solutions. Our commitment to excellence and continuous innovation sets us apart, providing our clients with a distinct competitive advantage.

Customizable Solutions

At Paygen, we understand that every business is unique, with specific needs and requirements. That’s why we offer customizable card processing solutions tailored to your industry, transaction volume, and business model. Our flexible approach ensures that you receive a payment processing solution that aligns perfectly with your operations, streamlining your processes and optimizing your revenue streams.

Transparent Pricing and Flexible Models

Transparency and flexibility are at the core of our pricing philosophy. We believe in providing clear and upfront pricing structures, ensuring that you understand exactly what you’re paying for. Additionally, we offer flexible pricing models to accommodate businesses of all sizes and stages, from startups to established enterprises.

Dedicated Support and Account Management

When you partner with Paygen, you gain access to our team of experienced professionals who are dedicated to your success. Our knowledgeable support staff is available to assist you with any questions or concerns, ensuring that your payment processing operations run smoothly. Furthermore, we assign a dedicated account manager to each client, providing personalized attention and tailored solutions to meet your evolving needs.

Integration with Leading Platforms

Paygen seamlessly integrates with a wide range of popular payment gateways, e-commerce platforms, and business management systems. This integration ensures a streamlined payment experience for your customers, while also simplifying your operational processes and reducing the need for manual interventions.

By choosing Paygen as your trusted card processing partner, you gain access to a suite of powerful solutions, backed by industry-leading expertise, unwavering commitment to security and compliance, and a dedication to delivering exceptional service that drives your business forward.

6. Conclusion

Navigating the complexities of card processing can be challenging, but with Paygen as your trusted partner, you can rest assured that your payment processing needs are in capable hands.

Throughout this blog post, we’ve explored the intricacies of the card processing lifecycle, emphasizing the importance of understanding each step to provide a seamless payment experience for your customers.

At Paygen, we take pride in our expertise and commitment to delivering reliable, secure, and efficient card processing solutions tailored to your business’s unique requirements. Our advanced technologies, robust security measures, and dedication to compliance ensure that your transactions are handled with the utmost care and professionalism.

Moreover, our competitive advantages, including customizable solutions, transparent pricing, dedicated support, and seamless integration with leading platforms, set us apart from the competition, providing you with a distinct edge in your industry.

Don’t settle for subpar payment processing services. Partner with Paygen and experience the difference that comes with working with a company that truly understands and values the needs of your business.

Take the Next Step

Are you ready to elevate your card processing operations and provide an exceptional payment experience for your customers? Contact Paygen today to schedule a consultation with one of our experts. Together, we’ll explore your specific needs and craft a tailored solution that drives your business forward.

Embrace the power of seamless card processing with Paygen – your trusted partner for secure, reliable, and efficient payment solutions.