What is Short Term Disability Insurance?

Short term disability insurance is a type of coverage that provides financial assistance to individuals who are temporarily unable to work due to an injury, illness, or other qualifying events. Unlike long-term disability insurance, which typically kicks in after a longer waiting period, short term disability insurance offers immediate support, usually within a few weeks of the disabling event.

Understanding Dave Ramsey Short Term Disability Insurance

Dave Ramsey is a well-known personal finance expert who emphasizes the importance of financial stability and preparedness. His approach to short term disability insurance is no different. Ramsey's Short Term Disability Insurance aims to provide individuals with peace of mind and financial security during unexpected life events.

Key Features and Benefits

Income Replacement: Dave Ramsey Short Term Disability Insurance offers a percentage of your income as replacement during the period when you're unable to work due to a covered disability. This ensures that you can continue to meet your financial obligations, such as mortgage payments, utility bills, and other living expenses.

Flexible Coverage Options: Ramsey's insurance policies typically offer flexible coverage options, allowing you to choose the benefit amount and waiting period that best suit your needs and budget. This customization ensures that you're adequately protected without overburdening yourself with unnecessary expenses.

Affordable Premiums: While the cost of insurance varies based on factors such as age, health status, and coverage options, Ramsey's Short Term Disability Insurance generally offers competitive premiums compared to other providers. This affordability makes it accessible to a wide range of individuals, regardless of their financial situation.

No Medical Exam Required: In some cases, Ramsey's Short Term Disability Insurance may not require a medical exam for coverage approval. This streamlined application process saves you time and hassle, allowing you to secure protection swiftly and efficiently.

Additional Resources: Beyond financial assistance, Ramsey's insurance policies may also provide access to additional resources and support services, such as rehabilitation programs, vocational training, and return-to-work assistance. These resources can help facilitate your recovery and transition back to the workforce seamlessly.

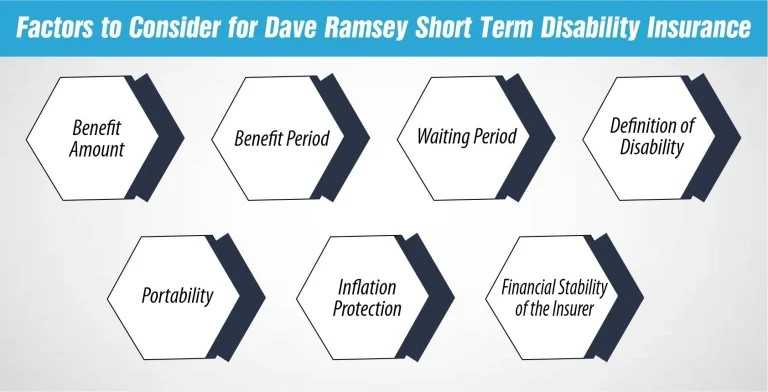

Factors to Consider for Dave Ramsey Short Term Disability Insurance

Is Dave Ramsey Short Term Disability Insurance Right for You?

While Dave Ramsey Short Term Disability Insurance offers numerous benefits, it's essential to assess your individual needs and circumstances before making a decision. Consider the following factors:

Employer Coverage: If your employer offers short term disability benefits as part of your employee benefits package, evaluate the coverage provided to determine if additional insurance is necessary.

Financial Obligations: Assess your financial obligations, including monthly expenses, debts, and savings, to determine the level of coverage required to maintain your standard of living in the event of a disability.

Health Status: Take into account your current health status and any pre-existing conditions that may affect your eligibility for coverage or the cost of premiums.

Budget: Evaluate your budget to ensure that the cost of insurance premiums is manageable within your overall financial plan.