Table of Contents:

- Introduction To Free Budget Spreadsheet

- Understanding the Importance of Budgeting

- The Power of Spending Spreadsheets

- Setting Up Your Spending Spreadsheet

- Tracking Income and Expenses

- Budgeting Strategies for Financial Success

- Utilizing Financial Templates for Efficiency

- Money Management Strategies for Long-Term Goals

- Leveraging Spending Planner for Retirement Planning

- Maximizing Savings: Money Saving Hacks

- Conclusion

Introduction To Free Budget Spreadsheet:

In today's fast-paced world, mastering your money is essential for achieving financial stability and realizing your goals. One powerful tool that can help you achieve this is a free budget spreadsheet. In this comprehensive guide, we'll explore how you can transform your finances and take control of your money using a free budget spreadsheet.

Understanding the Importance of Budgeting:

Budgeting lies at the heart of effective financial management. It involves tracking your income and expenses, setting financial goals, and making informed decisions about how you allocate your resources. Budgeting allows you to prioritize your spending, save for the future, and avoid unnecessary debt.

The Power of Spending Spreadsheets:

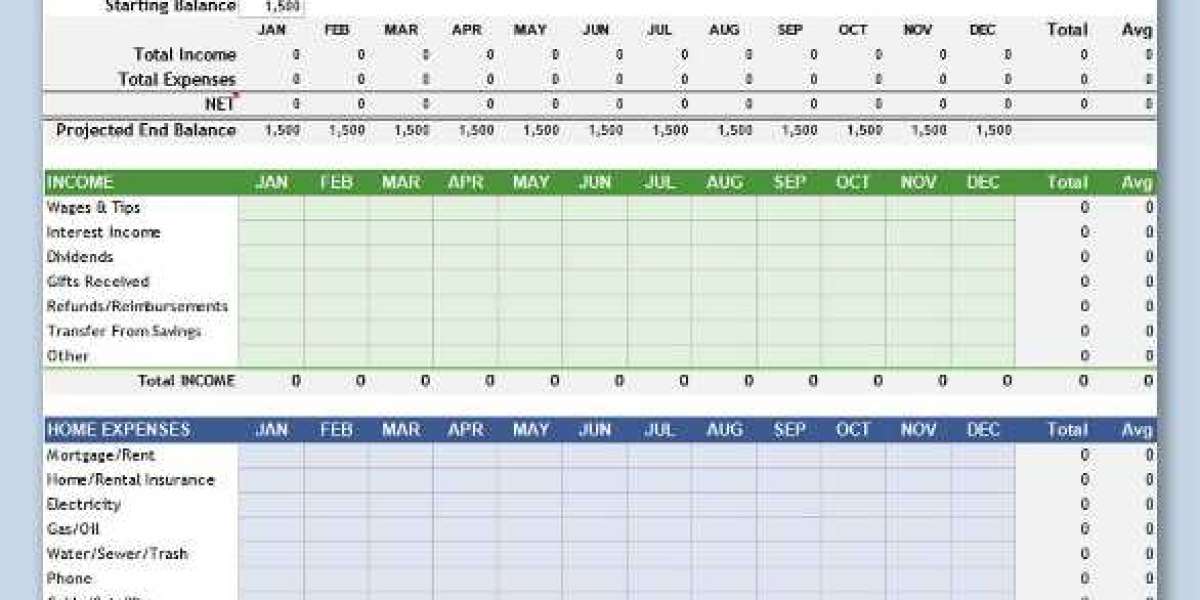

Free budget spreadsheets offer a convenient and accessible way to manage your finances. They provide a centralized platform for tracking income, expenses, savings, and investments. With customizable templates and built-in formulas, free budget spreadsheets streamline the budgeting process and provide valuable insights into your financial health.

Setting Up Your Spending Spreadsheet:

Setting up a free budget spreadsheet is simple and straightforward. Start by choosing a spreadsheet software or platform that meets your needs. Then, customize the template to reflect your income sources, expenses, and financial goals. Be sure to update your spreadsheet regularly to ensure accuracy and effectiveness.

Tracking Income and Expenses:

Monitoring your earnings and expenditures is vital to grasp your financial standing and execute well-informed choices. Use your free budget spreadsheet to record all sources of income, including wages, salaries, and bonuses. Categorize your expenses into fixed costs (such as rent and utilities) and variable costs (such as groceries and entertainment).

Budgeting Strategies for Financial Success:

Effective budgeting involves more than just tracking your income and expenses—it also requires strategic planning and discipline. Consider implementing budgeting strategies such as the 50/30/20 rule (allocating 50% of your income to needs, 30% to wants, and 20% to savings), or the envelope method (allocating cash for specific categories).

Utilizing Financial Templates for Efficiency:

Many free budget spreadsheets come with pre-built templates that you can customize to suit your needs. These templates often include categories for income, expenses, savings goals, and debt repayment. By utilizing these templates, you can save time and effort in setting up your budget spreadsheet and focus on achieving your financial goals.

Money Management Strategies for Long-Term Goals:

In addition to budgeting, effective money management involves planning for long-term financial goals such as retirement and investment. Use money management spreadsheets to track your progress towards these goals, allocate funds for savings and investments, and make adjustments as needed to stay on track.

Leveraging Spending Planner for Retirement Planning:

Planning for retirement is a critical aspect of financial management, and a free budget spreadsheet can be a valuable tool in this process. Use your spreadsheet to estimate your retirement expenses, track your retirement savings contributions, and monitor the performance of your retirement accounts.

Maximizing Savings: Money Saving Hacks:

Finally, maximize your savings by implementing money-saving hacks and strategies. Look for ways to cut unnecessary expenses, negotiate bills, and take advantage of discounts and rewards programs. By incorporating these savings strategies into your budget, you can free up more money to put towards your financial goals.

Conclusion:

In conclusion, mastering your money is essential for achieving financial stability and realizing your goals. By using a free budget planner, you can transform your finances and take control of your money. From tracking income and expenses to budgeting for long-term goals, a free budget spreadsheet provides the tools and insights you need to succeed financially. Start using a free budget spreadsheet today and take the first step towards financial freedom.

Recommended Article:Electrifying the Road: Remark EV and India's Top Electric Scooter Innovators