Fintech Technologies Market Overview:

Financial technology, or fintech, refers to the integration of technology into offerings by financial services companies to improve their use and delivery to consumers. It seeks to improve and automate the delivery and use of financial services, and it primarily works by unbundling offerings by such firms and creating new markets for them. Fintech companies leverage technology, such as mobile applications, artificial intelligence, blockchain, and data analytics, to enhance financial processes, improve customer experience, and drive efficiency. Here's an overview of the fintech technologies market. The fintech technologies market has experienced rapid growth in recent years, driven by advancements in technology, changing consumer behavior, and the need for digital transformation in the financial sector. The market is expected to continue expanding as more traditional financial institutions and consumers embrace fintech solutions.

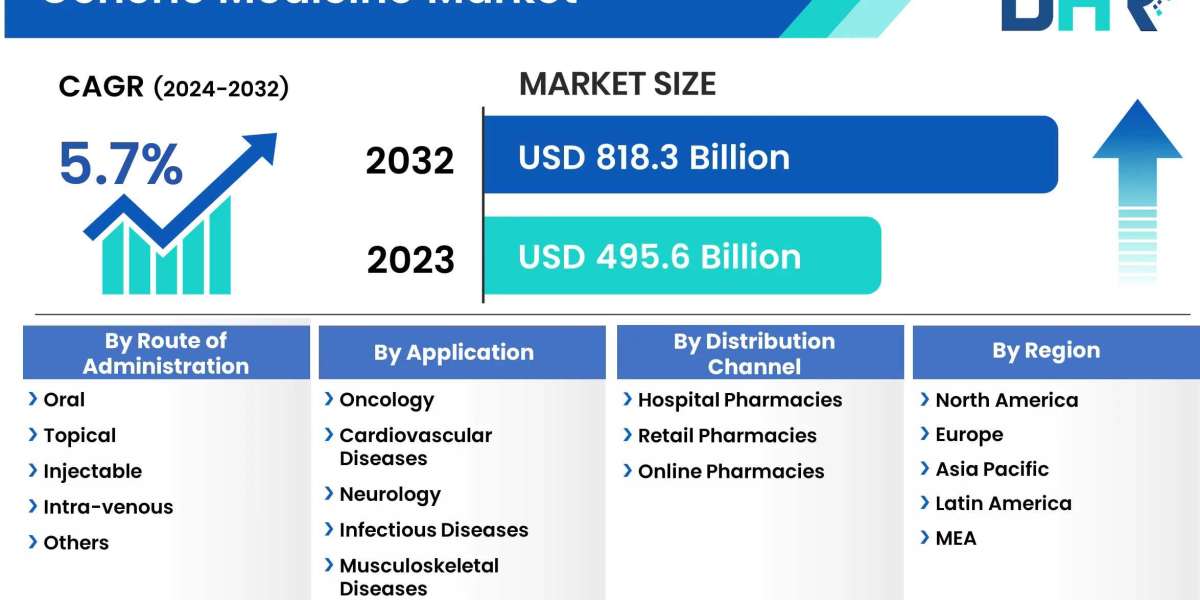

The fintech technologies market size refers to the segment of the financial industry that focuses on the application of technology to provide innovative financial services and solutions. The Fintech Technologies market to grow at USD 667.2 Billion by 2032, with a CAGR of 20.90% by 2032.

Top Key Players:

- Blockstream Corporation Inc.

- Circle Internet Financial Limited

- Bankable

- ORACLE

- TATA CONSULTANCY SERVICES LIMITED

- Cisco Systems Inc.

- Goldman Sachs

- NVIDIA Corporation

- IBM Corporation

- Microsoft

Get Free Sample PDF File:

https://www.marketresearchfuture.com/sample_request/11881

Fintech has revolutionized the payments landscape, enabling secure and convenient digital transactions. Mobile payment apps, digital wallets, peer-to-peer payment platforms, and contactless payment solutions have gained popularity, offering consumers alternative payment methods beyond cash and traditional banking systems. Fintech, short for financial technology, refers to the use of technology to provide innovative financial services and solutions. It encompasses a wide range of technologies and applications that aim to improve and streamline various aspects of the financial industry.

Technological Innovations:

Technological progress and innovation are the linchpins of fintech development and will continue to drive disruptive business models in financial services. Technologies such as smart contracts, zero-knowledge proof, distributed data storage and exchange, and blockchain are key to existing fintech innovations such as digital wallets, digital assets, decentralized finance (DeFi), and non-fungible tokens (NFT)

Market Development:

Online Lending and Alternative Financing: Fintech platforms have disrupted traditional lending models by providing online lending and alternative financing options. Peer-to-peer lending platforms, crowdfunding, and alternative credit scoring algorithms have expanded access to credit for individuals and small businesses, streamlining the lending process and reducing costs.

Personal Finance and Wealth Management: Fintech has introduced innovative solutions for personal finance management, budgeting, investment advice, and wealth management. Robo-advisors leverage algorithms and automation to provide low-cost investment advice and portfolio management services, making wealth management more accessible to a broader range of individuals

Insurtech: Insurtech companies use technology to streamline insurance processes, enhance underwriting capabilities, and improve the overall customer experience. Insurtech solutions include online insurance marketplaces, usage-based insurance, digital claims processing, and AI-powered risk assessment tools.

Blockchain and Distributed Ledger Technology (DLT): Fintech has embraced blockchain and DLT to enhance security, transparency, and efficiency in financial transactions. Blockchain enables secure and tamper-proof record-keeping, facilitating applications such as digital identity verification, cross-border remittances, smart contracts, and supply chain finance.

Open Banking and APIs: Fintech has driven the concept of open banking, which involves sharing customer data securely between banks and authorized third-party providers through Application Programming Interfaces (APIs). Open banking promotes innovation by allowing fintech companies to develop new financial products and services that integrate with existing banking systems.

Regulatory Environment: Fintech operates in a regulatory landscape that varies by jurisdiction. Regulators are working to strike a balance between fostering innovation and protecting consumers' interests. Regulatory sandboxes and initiatives to promote open banking and digital identity frameworks are being implemented to support fintech development.

Collaboration and Partnerships: Fintech companies often collaborate with traditional financial institutions, forming partnerships to leverage each other's strengths. This collaboration enables incumbents to access innovative technologies and expand their digital offerings, while fintech companies benefit from the infrastructure and customer base of established institutions.

Global Market: The fintech technologies market is global, with significant growth and innovation occurring in regions such as North America, Europe, Asia-Pacific, and Latin America. Each region has its unique fintech ecosystem, influenced by local regulations, consumer preferences, and market dynamics.

The fintech technologies market continues to evolve rapidly, shaping the future of the financial industry. As technology advances, fintech companies are expected to drive further disruption, innovation, and transformation across various financial sectors, ultimately providing consumers and businesses with more accessible, efficient, and inclusive financial services.

Access Complete Report:

https://www.marketresearchfuture.com/reports/fintech-technologies-market-11881

Related Articles:

https://www.openpr.com/news/3431889/us-satellite-data-service-market-worth-cagr-of-23-50-by-2032-key

https://www.openpr.com/news/3432015/cloud-sandboxing-market-size-worth-7-5-billion-by-2032-growing

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching "Wantstats" the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: [email protected]

Website: https://www.marketresearchfuture.com